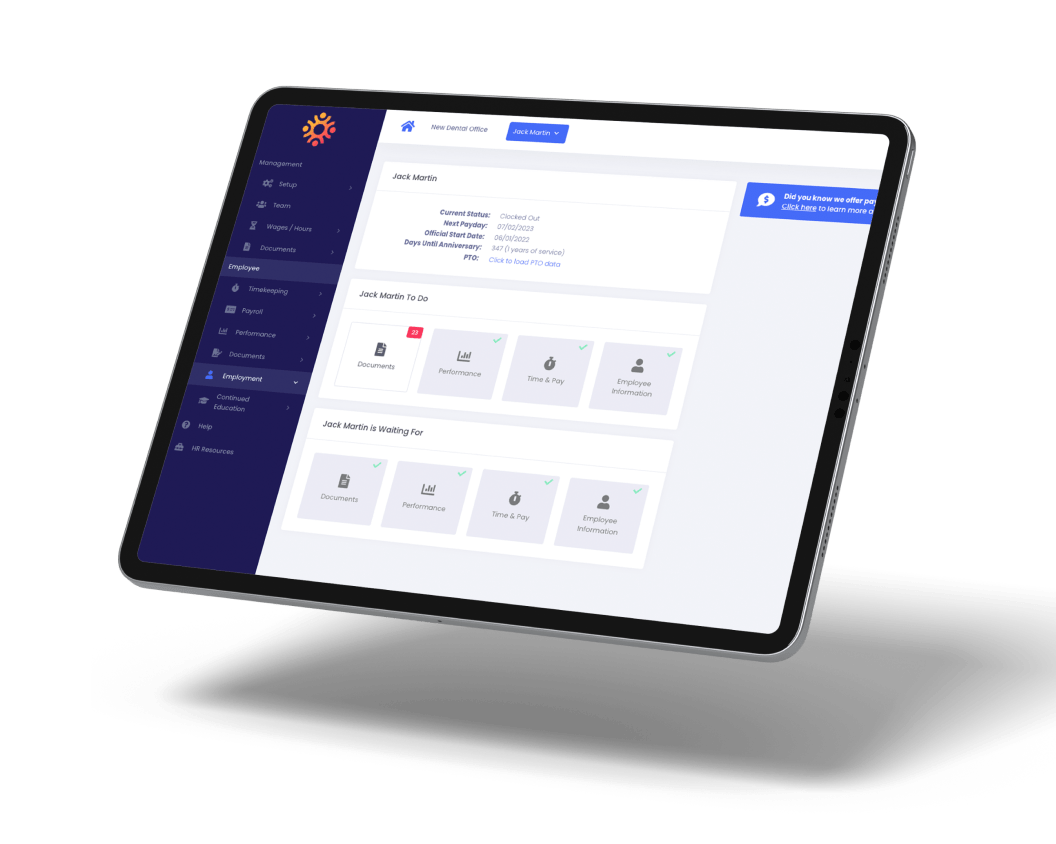

Payroll Solutions

Do payroll faster. Easier. Compliant-er.

HR for Health makes payroll better for healthcare practices. It’s streamlined. It’s automated. And it’s done right and checked by legal experts, so you don’t get sued.

Compliance doesn’t mean sacrificing convenience. In fact, having all of the legalities baked in makes your life easier. Let’s take “I hope that’s right” out of your payroll vocabulary. With the only HR software built for healthcare.