401(k) Retirement Planning

401(k) management doesn’t have to mean 401 headaches

HR for Health makes 401(k) management simple. Whether we handle it for you or report to another provider. Making everyone’s road to retirement a little easier.

401(k) Retirement Planning

HR for Health makes 401(k) management simple. Whether we handle it for you or report to another provider. Making everyone’s road to retirement a little easier.

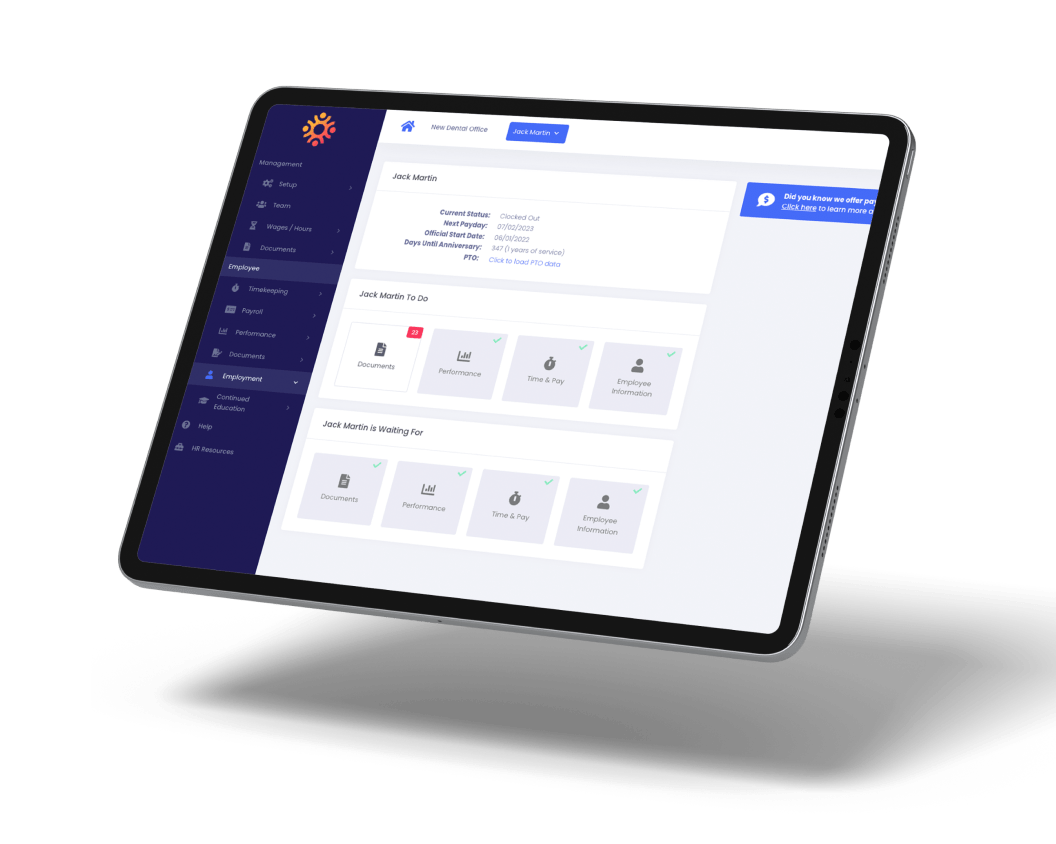

The All-in-One HR Software Trusted by 3,000+ Healthcare Practices

Dental | Medical | OPTOMETRY | CHIROPRACTIC | MED SPA | VETERINARY | GROUP PRACTICE |

Letting us handle your 401(k) is like giving an F1 team your car keys: you’re trusting the right people.

We work with trusted retirement planning specialists to make sure your money is put to work. And we make sure you and your people have all the flexibility they need to hit their goals.

Securing your teams future, without the usual mountain of stress and admin work.

Working with HR for Health doesn’t mean losing your trusted 401(k) provider. We report your data directly to them. If we were legally able to, we’d say it’ll definitely lower your blood pressure.

That’s because we cut paperwork, time, and, most important, the chances of things getting lost in translation.

Protecting you, your people, and your practice.

Managing people can be hard.

Make it less hard.

Running a top-notch team can be rewarding, but there’s no sugarcoating it: it’s time-consuming (especially to do it well). Time off, performance reviews, PTO, termination… All of those time-eating HR tasks are done faster with HR for Health.

*Unless they’re certified HR professionals

Get your very own on-demand HR team (without the extra payroll expenses). You can shoot us an email or call our HR hotline during your workday, or access the HR Knowledge Base 24/7.

What makes our HR solution different?

It’s in the name:

HR for Health

There’s a lot of HR software solutions out there, but there’s only one that’s designed by a practitioner and an attorney specifically for dental and medical practices. That’s us. Every feature, function, and product is designed for healthcare teams. No other HR solution can say that.

Customized & Compliant Handbooks

You don’t need to keep up with employment law, but your policies definitely do. We automatically update your policies and handbooks to account for changes to laws and regulations at the local, state, and even federal levels.

Compliance-First.

Always.

Just because you haven’t faced a lawsuit doesn’t mean it’s not coming. Other software leaves compliance up to you. We take care of it with a total solution that ensures you stay legal.

Practice Protection = Profit Protection

Every year thousands of practices are attacked with expensive lawsuits that not only cost a lot but cause irreparable reputational damage. Simply keeping compliant allows you to mitigate nearly 99%* of HR-related legal claims. *1% of legal claims require beating someone with a stick.

401(k) Retirement PlanningFAQs

First, research reputable 401(k) providers and ask similar practices about their experiences. Next, choose a plan that works for you.Once you’ve picked a plan, you can start setting up your employees. Create a plan document that complies with the IRS Code and sets out the details of your retirement plan. Then, set up a trust to hold the plan assets, with a trusted trustee in charge. Over the life of the plan, make sure you’re maintaining the records of 401(k) employees and their current plan values. Finally, provide the required information to your employees.Choosing the right payroll and HR software makes this process much easier through automation and standardized reporting.

You should do your research, building a list of trusted companies that will provide excellent service, and that will be around for years to come. You can also ask around at practices similar to yours to see if they have any providers they like or special insights.If you trust HR for Health with selecting your plan provider, you can be sure we’ve done all of that research and more. We take taking care of your retirement savings very seriously.

When you communicate your 401(k) plan to your employees, focus on using plain language that everyone can understand. Use simple English, short sentences, and bullet points. Provide your employees with explanations of terms like matching contributions, vesting schedules, and loan features. Make it easy to see and understand the ways they can diversify their investments. And make it easy for you and your employees to check in on savings goal progress together.

There are a few common ways employers fail to comply with 401(k) plan regulations. Make sure you do tasks on time, from updating your plan document, depositing participant contributions, and filing your annual Form 5500. Make sure your follow your plan document precisely. Keep a close eye on eligibility requirements and perform ADP/ACP nondiscrimination testing. And make sure you’re using the right definition of compensation to calculate deferrals.Payroll compliance is hard. That’s why most HR professionals get software that makes it easier. Because smart HR people know that software is a lot cheaper than lawsuits.

401(k) plans are a win-win, great for employees and great for employers. But it can be hard to get employees to get over the paperwork hump and enroll. Four ways to improve participations are: Make the plan easy to join by reducing waiting times, making the plan an opt-out rather than opt-in, and auto-filling as much of the paperwork as possible Offer plenty of opportunities to learn about the plan, from posters to newsletters to emails Hold several group open enrollment sessions — peer pressure can be a powerful tool Provide materials that help employees learn about financial wellness and investing. A reminder about the power of compound interest can go a long way!

Transitioning former employees out of 401(k) plans saves you plan costs, fiduciary responsibilities, and audit risk. If a former employee has a balance of $5,000 or less, you can do a “force out,” which should be a provision in your plan document (if it’s not, add it now!). With it in place, you can automatically remove anyone with a small balance out of the 401(k) after a 30-day written notice. If the former employee has a balance over $5,000, you can’t force them out. Instead, your service providers can do an outreach campaign to encourage a conversation around shifting.

Our team of HR experts are here to help you. Let’s connect.

Welcome to the HR software suite that will change your life.

Explore more HR solutions from HR for Health