Throughout the United States, each state has its own distinct labor laws that apply within their jurisdiction. These laws cover a wide range of employment matters such as overtime, minimum wage, sick leave, and many others. This leaves employers and employees alike with a pertinent question: Do California Labor Laws apply to out-of-state employers?

The answer to this question isn’t completely straightforward. It mostly depends on the specific circumstances of the out-of-state employer’s interactions with California and its residents. Understanding your responsibilities as an employer from another state in California is important to follow the law and prevent legal issues.

California Labor Laws and Out-of-State Employers

To begin with, California labor laws are some of the most comprehensive and protective in the country. The state exerts great effort in upholding these regulations to ensure the rights and welfare of all its workers.

Usually, these laws primarily apply to employers operating within the geographical boundaries of California. However, there are particular situations where out-of-state employers may find themselves under the jurisdiction of California labor laws. The central determinant of these situations is the relationship between the employer, the employee, and the state.

For instance, if an out-of-state company employs a California resident who performs work in California, there is a high likelihood that California labor law will be applicable to that employment relationship. Similarly, if an out-of-state employer engages employees in temporary work within California, California labor law would likely govern those employments.

Legal Precedence and Interpretation

Legal precedents set by court decisions have clarified California labor laws’ expected applicability to out-of-state employers. A notable case is Sullivan v. Oracle, where the California Supreme Court ruled that California overtime laws applied to non-residents who worked in California for a company based in a different state.

In addition, the California Labor Code incorporates specific provisions that seem to imply jurisdiction over out-of-state employers. For example, Labor Code Section 558.1 states that anyone (corporate officers or executives) who causes violations of wage payment laws could be held liable, even if they are operating from out-of-state. This provision suggests that California labor authorities could hold out-of-state employers accountable for violations under California labor laws.

Challenges Faced by Out-of-State Employers

Operating from another state, out-of-state employers may face unique challenges in keeping up-to-date with California’s labor laws. These laws are frequently updated, and the sheer duration may pose difficulties for employers based outside the state. An approach to minimize these challenges could be to seek guidance from legal experts or agencies specializing in California Labor Law compliance.

A common pitfall that out-of-state employers might encounter is the lack of familiarity with California-specific mandates, such as the requirement for suitable seating for employees under certain conditions, reporting time pay, and specific regulations on meal and rest breaks, amongst others.

What Does All of This Mean?

So, do California labor laws apply to out-of-state employers? The answer ultimately comes down to the specific context of the employment relationship. In general, if work is performed in California, the state’s labor laws are likely to apply — with potential implications for both part-time and full-time, in-state and out-of-state workers.

Given the complexity of state labor laws and the potential for costly non-compliance, out-of-state employers with employees in California should regularly consult with legal counsel or human resources advisors familiar with California labor laws to ensure compliance.

Remember, as an employer, understanding the law isn’t just about avoiding penalties or lawsuits. It’s also a critical part of building trust and engagement with your employees. An employer who cares about following legal requirements is one who cares about their staff, leading to more dedicated workers and a better overall work environment.

In short, it is urgent and beneficial for out-of-state employers to understand how California labor laws might apply to their situation to protect both their interests and those of their employees.

Where Does HR for Health Help Me?

Out-of-state employers with operations in California often face the challenge of managing different sets of labor laws. This is especially true when employers operate a physical office in California with other employees or locations in different states. It can be complicated and time-consuming to remain updated and compliant with these jurisdiction-specific regulations. Herein lies the immense potential of leveraging HR software solutions, such as HR for Health, to simplify these complexities.

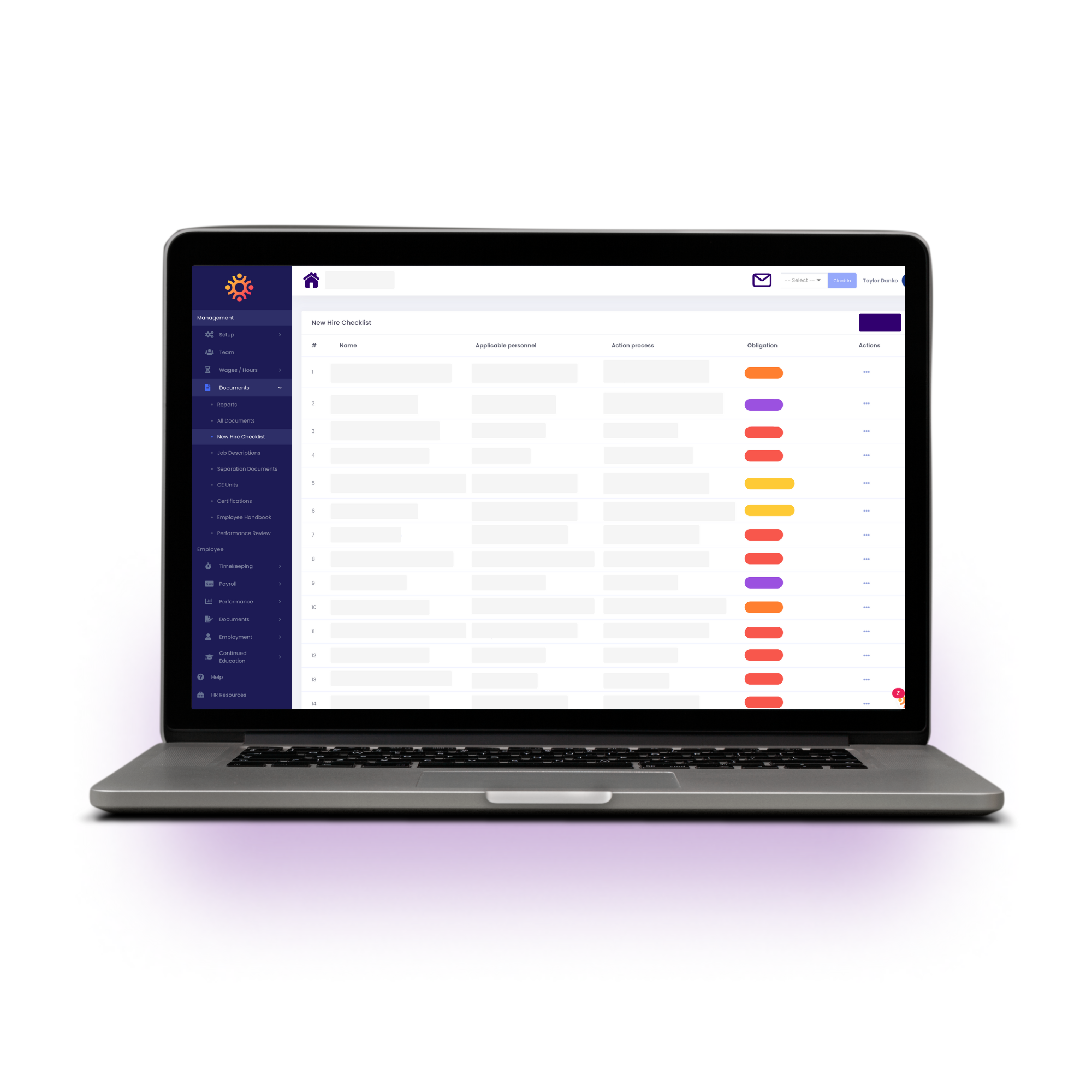

Centralized, Streamlined HR Management

HR for Health software serves as a centralized platform providing streamlined management for multiple offices. It facilitates effective oversight and coordination of HR functions across geographic boundaries, ensuring standard procedures while considering the nuances of individual state laws.

Compliance with State Labor Laws

This software is designed with the intricacies of labor laws in mind. The cloud-based, compliant system provides the tools necessary to ensure your practice is compliant with state-specific labor laws, regardless of where your offices are. It allows employers to set policies according to different state regulations, providing an invaluable resource for practice owners managing offices in California and other states.

Automated Systems for Complex Calculations

The complexities of regulations, such as overtime calculations, can vary from one state to another. HR for Health can greatly simplify these with its powerful automated systems. It can accurately calculate overtime wages based on California laws for your California-based office while simultaneously managing calculations for other offices in different states as per their respective laws.

Seamless Time-Tracking

To support your practice’s adherence to state stipulations on employee breaks, the software has robust time-tracking features. These features help ensure that mandatory break times as per California labor laws are adhered to while managing different break requirements for offices in other states.

Records and Reporting

Maintaining accurate and comprehensive records is not only a requisite for effective HR management but also crucial in demonstrating compliance with state labor laws. HR for Health’s comprehensive reporting feature aids practice owners to easily generate essential HR reports, vital to both practice management and proving regulatory compliance.

Simplified Pay Roll Management

One essential feature is seamless integration with payroll systems. The software can assist in managing payroll complexities related to differing state laws, ensuring that all your employees, regardless of their locations, are paid accurately, and on time.

HR for Health software is a dynamic HR management solution for employers confronting the complexities of managing a workforce subjected to different sets of labor laws. By leveraging its various features, practice owners with offices in California and other states can ensure they remain up-to-date, streamlined, and compliant with respective state labor laws. A more efficient HR workflow ultimately translates to a better work environment, contributing to enhanced productivity and employee satisfaction.